In today's rapidly evolving financial landscape, FinTech is taking center stage, offering consumers innovative solutions to manage their money with greater ease and accessibility.

It's not just a revolution; it's also big business. A quarter of CB Insights' 100 Most Promising Fintech companies are now focused on the consumer market, encompassing challenger banks, mobile wallets, and retail investing platforms.

To gain a deeper understanding of consumer perspectives on these digital financial tools, we conducted a comprehensive survey involving 500 participants in the US, spanning different generations and genders. Our aim was to uncover their thoughts on FinTech services, identify which offerings are capturing their attention, and explore the factors that influence their usage.

Creating Connection

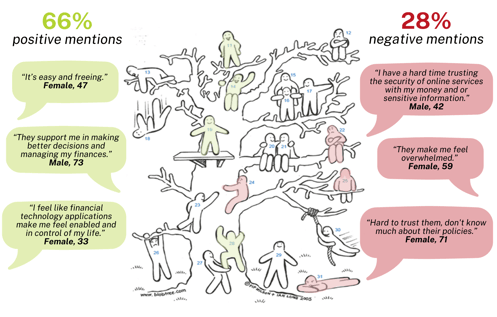

Our research began with a unique quali-quant projective technique we call “blobs”, where we explored whether FinTech lives up to its promise of transforming the banking experience and empowering consumers.

Respondents were asked which amorphous, genderless, and ageless character represents how they feel about using online financial services or apps. Two-thirds of respondents selected their "blob" because it evoked positive emotions or phrases, such as happiness, being “on top of things” or being comfortable and laid back. These mentions indicate a strong connection to these innovative solutions.

What’s in Consumers’ FinTech Portfolio?

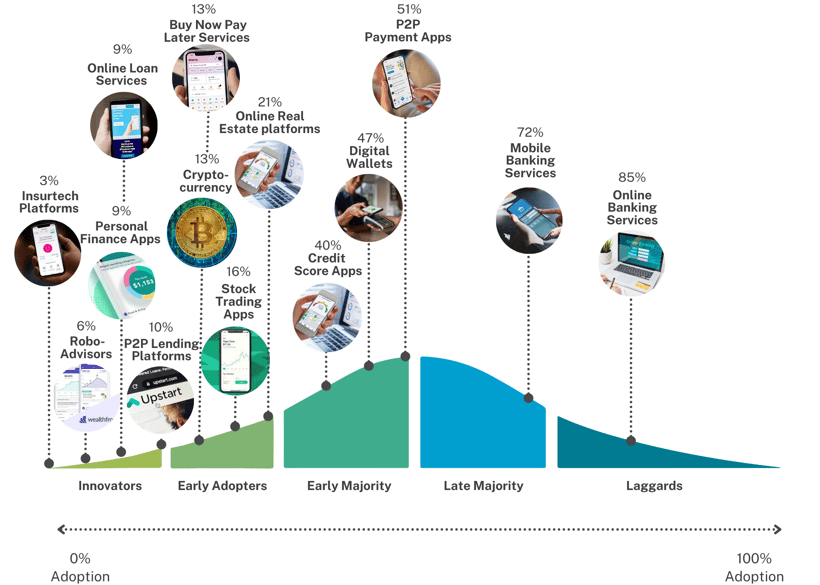

We then delved into the adoption of 14 categories of B2C FinTech apps and services by asking, “Which of these do you currently use?" We wanted to assess what is sticking, given that most users have more than 80 apps installed, but use 9 apps per day on average and 30 apps per month.

The clustering of apps/services toward the left side of the curve suggests the infancy of the tools and potential upside if they follow a course like online banking, which has been adopted by all but the laggards. It came as no surprise that they boasted high adoption rates across all generations (85% or higher). The driving force behind the growth in P2P payments and digital wallet adoption was Generation Z (65%) and Millennials (69%). Half of GenX consumers also reported adoption of these services.

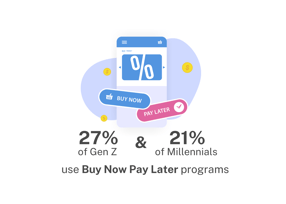

With the holidays upon us, Buy Now Pay Later (BNPL) is a retail strategy favored by GenZ and Millennials. Though not yet mainstream usage, 74% of those we surveyed who used Klarna, Afterpay or Affirm reported they were very or extremely satisfied.

We were surprised by the relatively low overall adoption rate (16%) of stock trading apps, despite approximately 55% of American adults having direct or indirect ownership of stocks. Is the user experience having an impact? Are respondents were less satisfied. We found that 54% of stock trading app users were very to extremely satisfied compared to user satisfaction rates of 77% with online and mobile banking. Could barriers that impact FinTech in general, like fear of data breach, be a factor?

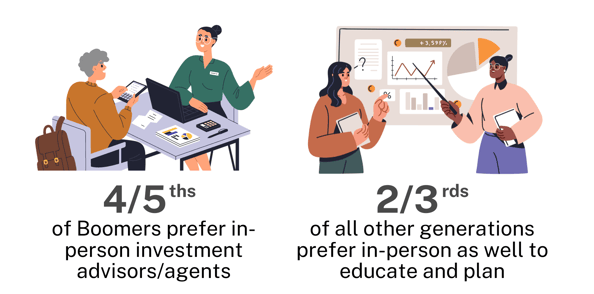

Usage of stock trading apps averaged 37% in all generational groups besides Boomers (20%). However, given that investing and financial planning are more complex personal finance activities, our findings show we all prefer help from a real person, but for different reasons.

Usage of stock trading apps averaged 37% in all generational groups besides Boomers (20%). However, given that investing and financial planning are more complex personal finance activities, our findings show we all prefer help from a real person, but for different reasons.

Assessing the usage of traditional and technical services for banking, purchasing, budgeting, and investing highlights the struggles of cryptocurrency, with 8% overall using it and the opportunity for budgeting and personal finance apps like Mint or YNAB to win over the 56% of consumers who continue to use Excel/paper records.

Benefits and Barriers

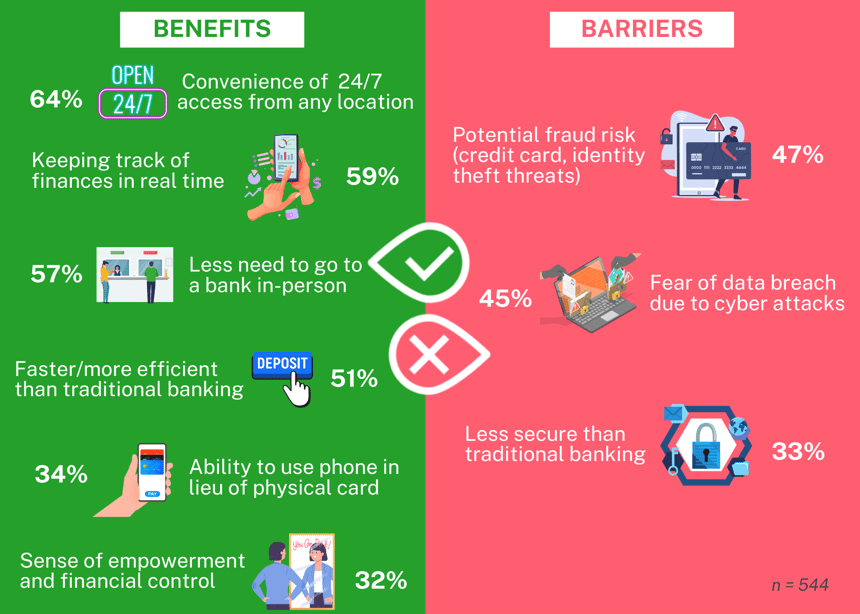

When weighing perceived benefits and barriers, B2C FinTech is delivering on its promise of providing access, ease, and efficiency. This transformation is not just about technology; it's about the financial empowerment of individuals.

Breaking Through in a Crowded Space

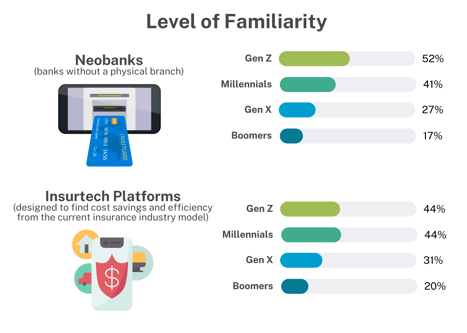

Our study found that neobanks and insurtech are still in the early-adoption stage both with adoption rates below 5%. These products challenge traditional banking and insurance models by eliminating physical branches and agents, respectively.

To assess familiarity, we employed variations of questions like "Have you heard about it?" and "What is your level of understanding?" As expected, younger generations are the primary target for these FinTech products, and this is reflected in their higher familiarity levels compared to older generations.

Converting familiarity into new users will require neobanks and insurtech providers to communicate the ease, convenience, and empowerment benefits of the services and apps that are now mainstream.

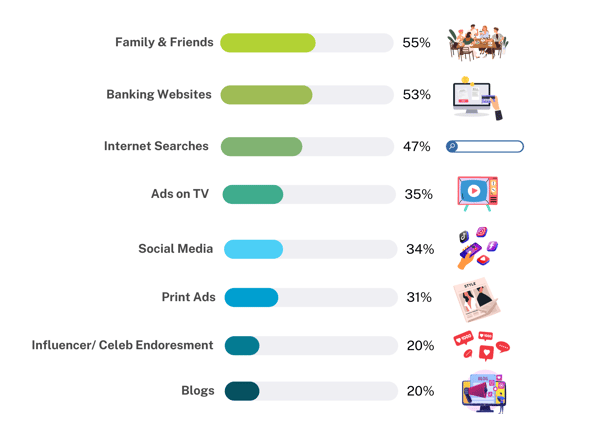

Tailored strategies to effectively reach key demographic targets are a standard part of marketing activation. When it comes to learning about financial services products, our survey found that the personal network of family and friends is the top source (55%) overall. Gen Z relies on social media (64%), Millennials prefer search engines (59%), and Gen X and Boomers turn to bank websites (58% and 55%, respectively).

The next post in this series will dive further into the generational and brand level insights.

________________________________________________________________________________

Data collected in November 2023, 500 US respondents, balanced for gender and generation