In November, we surveyed consumers in the US about FinTech to understand if it lives up to its promise of transforming the banking experience and empowering consumers. Due to the topic’s multi-faceted nature, we are now diving into GenZ.

This generation finds itself at the forefront of the financial revolution and has access to more financial options and opportunities than ever, mainly due to the rise of FinTech. This is opportune, given the growing awareness and alarm regarding the lack of financial literacy among high school graduates. Will FinTech help reverse the course?

GenZ’s attitudes about technology and finance reflect a juxtaposition. They are the first digitally native generation and natural fintech adopters, but due to their lack of financial knowledge, may fall victim to the “a fool with a tool is still a fool" idea. The essence of this quote by Grady Booch, computer scientist and co-creator of the Unified Modeling Language (UML) is that possessing a tool or technology alone does not guarantee competence or success; true proficiency comes from understanding and skillful use of the tools at one's disposal. In the case of GenZ, to use the tech, one needs to be financially literate.

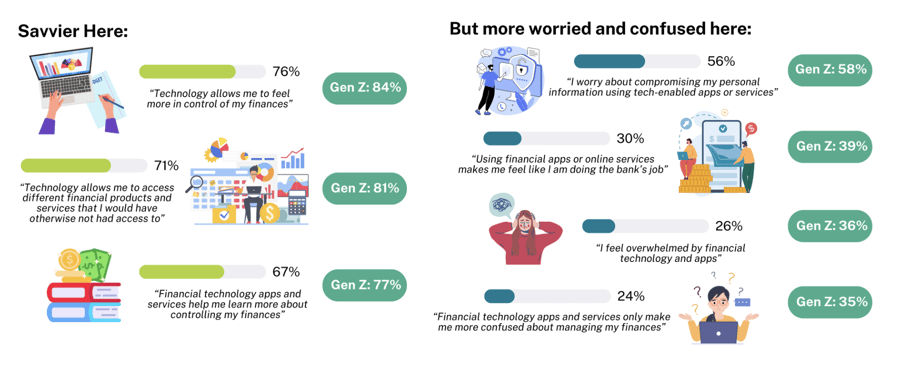

This contrast in tech and financial confidence plays out attitudinally:

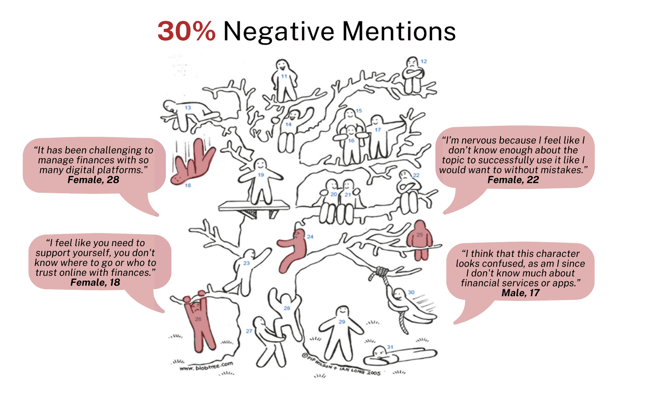

We also asked GenZ survey participants to complete a unique quali-quant projective technique we call “blobs”. Respondents were asked which amorphous, genderless, and ageless character represents how they feel about using online financial services or apps and why. We know that emotions are behind financial goals and decisions, which is why we used this technique.

As hypothesized, we saw in the sentiment from Gen Z respondents that 30% of the mentions conveyed their struggle to comprehend the complexities of financial products and services, leading to confusion, anxiety, and feeling overwhelmed. On the other hand, themes from the Millennial, GenX, and Boomer cohorts tended toward privacy and security, neutrality (no strong feelings), or general confusion about technology.

Brands need to manage the confusion and overwhelm. Consumers (no matter their era) increasingly tie financial and digital literacy to overall wellness. Security & stability, freedom of choice, self-esteem, social belonging & connection, and future planning & legacy are the core needs Fintech should aim to fulfill.

To activate effectively, our advice to clients is to pursue the why relentlessly. Ideas, concepts, messages, and all forms of communication need to address nuanced emotional and functional needs, and connecting with Gen Z is no different.

To illustrate this, we created a Fintech concept and tested it with consumers via Express, our automated consumer insights platform for quick turnaround.

Our concept resonated emotionally with the GenZ respondents based on the perception that it would “relieve financial stress”, was inspiring, and would help them plan their finances better.

-Feb-21-2024-08-17-59-4949-PM.png?width=873&height=715&name=Untitled%20design%20(1)-Feb-21-2024-08-17-59-4949-PM.png)

When looking at where they turn to for financial help, our survey found that 64% of GenZ rely on social media, followed by Friends/Family (57%) and Internet search (51%). While members of the other cohorts rely heavily on banking websites (55-58%), only 42% of GenZ utilize financial institutions for assistance. Attitudinally, Gen Z had the strongest agreement with the statement, “Using financial apps or online services makes me feel like I am doing the bank’s job.” This implies that they see no added value and that they do the work while paying the financial institution for it. Many banks are upping their customer experience efforts, but this cohort isn’t seeing it.

Apart from our own research in this space, we worked with a financial institution to help them evolve their brand to fit a digital experience and serve the current and future member base in an emotionally compelling way. Our quantitative and qualitative methods kept people at the forefront of the research, providing us with rich insights to better understand the GenZ cohort and find the best solution for their visually immersive digital platform.

This sense of feeling lost and over their heads in terms of following their financial path with success played out there, too. They have fully embraced digital tools, but those currently available don’t provide them with the full picture of their finances, nor actively engage them in developing plans to meet their goals.

The power of FinTech for Gen Z is undeniable. By embracing digital finance and leveraging the various FinTech tools available, young adults can transform their financial lives and build a foundation for their overall wellness. But as our study conveys, work must be done to keep their overwhelm from turning into a funnel of self-doubt. Our next series will profile members of the GenZ cohort to understand their journey qualitatively.

________________________________________________________________________________

Data collected in November 2023, 500 US respondents, balanced for gender and generation